Ironically, the people who would benefit most from using price comparison websites - that is, those with the least amount of discretionary income living near the poverty line - are the least likely to use them.

Research shows that this is due to a multitude of factors. Including:

lack of knowledge and education;

lack of economic opportunities and belief in long-term saving;

an attitude and mindset that prioritises ‘living for today’; prioritising ‘realistic’ short-term treats and rewards over investing in a somewhat bleak future

a deep skepticism and distrust of the financial services industry

Because of this, people in this audience segment often get caught in a downward spiral. Spending more money on utilities, credit cards, insurance and other essentials than their more savvy, affluent counterparts - and in-turn becoming more in-debt, short-termist and vulnerable to poor economic decision making.

And so the cycle continues.

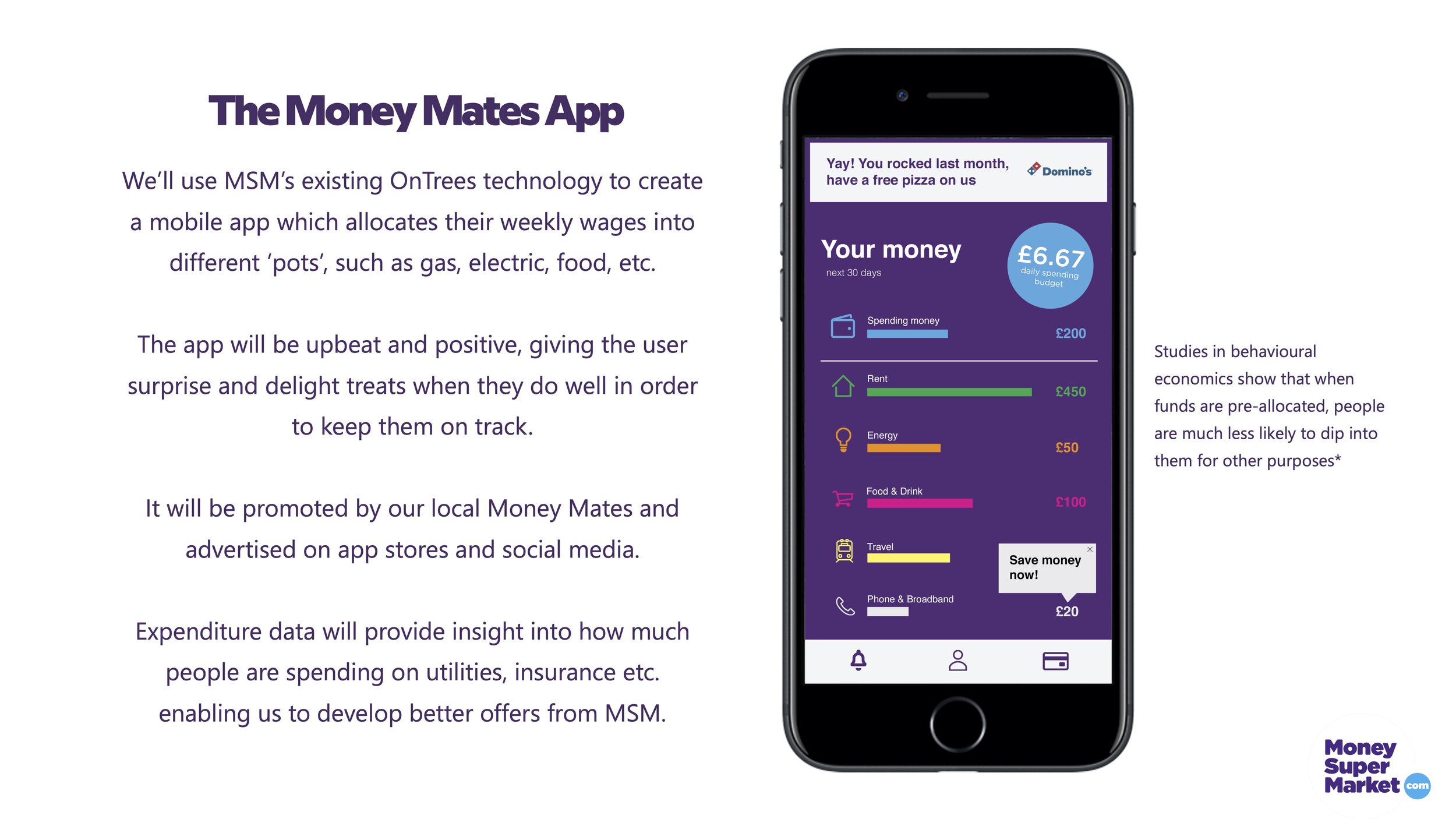

To address this, we developed a strategy for MoneySuperMarket that aimed to stage a series of friendly and accessible interventions with these consumers. Helping them to become more confident and capable with their finances, and create better outcomes for themselves.

Interventions included an AI-driven mobile app that budgets income as it comes in, to avoid overspending; a series of financial literacy education packs handed out in schools; a suite of advertising that stopped people from taking out payday loans and gave them better options; and a grass roots volunteer programme providing local expertise and support groups to those in need of advice.

CREATIVE | CONTENT | DIGITAL | CUSTOMER EXPERIENCE | INNOVATION

Agency: Cherry London | Work: Pitch Only